We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

What good is cheap debt on a truck if you have nothing to ship?

Within the coming months there will be a lot of discussion in the media about the macro-economic policy and direction of the country. They can be deceptive, as individuals in the media, politicians and policy advisors tend to discuss the outcomes of any particular action in average terms. Usually this is based on level 100 or lower economic theory (especially in the case of media commentators and politicians).

However, as an individual household or business owner you will have to deal with, not only the scenarios outside of the average response to any given policy, but also the delay between a particular lever being pulled and the effect on the economy. Any given policy is designed to ‘bolster the economy’ but even if you are the target recipient of that bolstering, your mileage may vary.

As an example, I have taken three currently circulating macro-economic policies; one from the current government, one proposed from the opposition, and finally one from the politically neutral Reserve Bank.

There are many different and fascinating conversations to be had macro-economically about each of those policies. The macro-economic questions (refer below) are far more likely to be discussed in the media and trumpeted by politicians because they are interesting. However, the small business or household should be asking three identical questions (also below) of each proposal, none of them macro-economic.

- Labour is providing minimal assistance to small business, limited almost entirely to the small business loans.

Macro-economic question:

Is Labour abandoning small businesses in a shutdown that it has administered?

Question you can ask:

Do I have sufficient income (in the form of sales or wages) to cover my expenditure?

- National is proposing far greater small business assistance, including a large GST refund.

Macro-economic question:

Is the tax relief and business assistance proposed by National actually going stimulate the economy, or will trickle-down not occur?

Question you can ask:

If I do have sufficient income, is there anything I can spend money on to improve this?

- The Reserve Bank is signalling historically low interest rates for an extended period of time.

Macro-economic question:

Should the target of the Reserve Bank be solely inflationary, given that it has had to step in for the National government on housing and now the Labour government for the lock down?

Question you can ask:

If I don’t have sufficient income, will some form of cash flow relief be able to bridge me until a future time when I do?

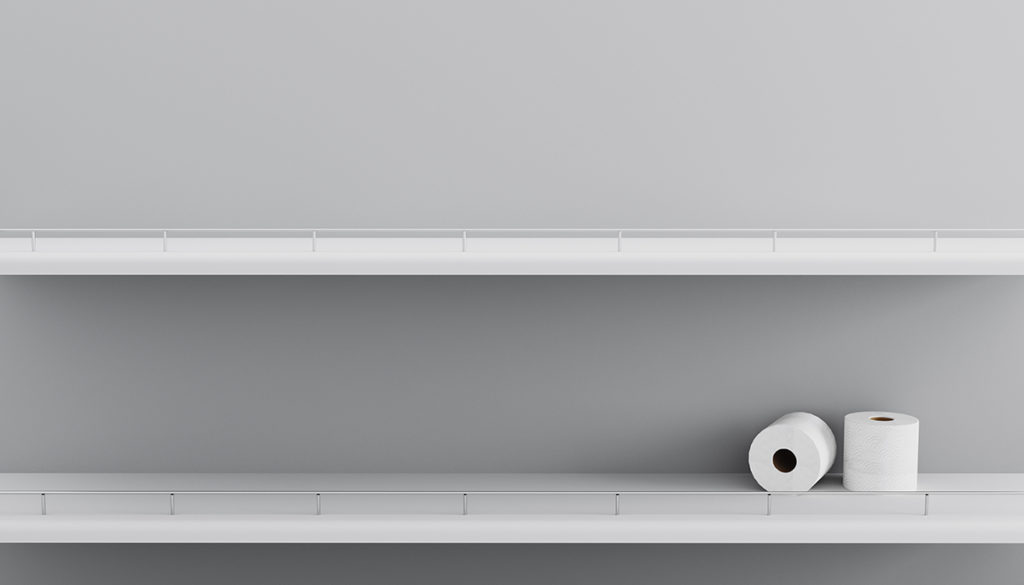

Although those questions might seem reductive, it is important to note that each one of the different policies deals with freeing up funding for businesses. However, none address the central problem of a lack of customers or sales. What good is cheap debt on a truck if you have nothing to ship? What good is cheap bridging finance if your sales are not going to return? And what good is a massive tax break if you no longer have a taxable activity?

Support for aggregate demand has and will continue to exist however, no government or government agency likes to pick winners and losers in business, because it is a very complicated problem.

If this article has touched on any issues you are having in your business, get in touch with Robert and he can direct your enquiry to our team of specialists.

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events