We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

Planning for Success with Succession Planning

Over at least the last decade, Succession has been topical in business advisory. Largely the focus has been on getting a business ready for sale or exit, and addressing the importance of intergenerational businesses to address interfamily expectations, and on strategies for finding an heir or successor. Most people are naturally averse to considering mortality, or ‘the end’. Let’s alternatively consider succession a planning exercise – not necessarily for exit, but as just another business decision combined with your annual review. Any business decision requires timely and relevant information, careful consideration and analysis of options.

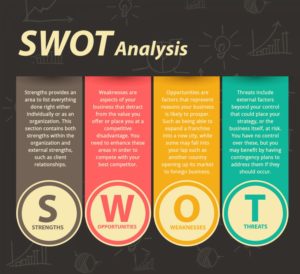

The focus on selling a business for succession purposes is an appropriate one, as around 90% of New Zealand businesses have less than 20 owners and a large portion of these are less than five. Many of these businesses have essentially been jobs for the present owners. These businesses can be split into those which have a large market of potential buyers (not highly specialised or niche industries), with the balance of the businesses requiring specialist industry knowledge or skills. The former are easier to sell as there is a larger market for these businesses. Usually these businesses sell for similar multiples of earnings, however some planning and grooming could facilitate a higher price. It is important to know when you are likely to sell, and what the value drivers are for your industry and specific business. The starting point is to perform a SWOT Analysis of your business – where is the business vulnerable, and what strategies can be put into place now to counter both internal and external vulnerabilities. In addition consider what can be done to exploit your strengths and opportunities. This should be done on an annual basis, with consideration to timing of any potential sale. You should also have an idea of the value of your business, especially 3-5 years prior to any potential sale. The value of your business should not be a surprise when you are ready to sell.

The focus on selling a business for succession purposes is an appropriate one, as around 90% of New Zealand businesses have less than 20 owners and a large portion of these are less than five. Many of these businesses have essentially been jobs for the present owners. These businesses can be split into those which have a large market of potential buyers (not highly specialised or niche industries), with the balance of the businesses requiring specialist industry knowledge or skills. The former are easier to sell as there is a larger market for these businesses. Usually these businesses sell for similar multiples of earnings, however some planning and grooming could facilitate a higher price. It is important to know when you are likely to sell, and what the value drivers are for your industry and specific business. The starting point is to perform a SWOT Analysis of your business – where is the business vulnerable, and what strategies can be put into place now to counter both internal and external vulnerabilities. In addition consider what can be done to exploit your strengths and opportunities. This should be done on an annual basis, with consideration to timing of any potential sale. You should also have an idea of the value of your business, especially 3-5 years prior to any potential sale. The value of your business should not be a surprise when you are ready to sell.

Businesses requiring specialist industry knowledge or skills have a smaller market of buyers, therefore are likely to require more thought on exit strategies. Is there the possibility of growing such a business to a point where the owners are able to put management, and eventually governance into place? In this case, an owner has more time to consider timing of exit as they are able to step back and take their time to sell, or even identify and groom an employee to incentivise as a shareholder or for complete sale.

In both cases, it is important to start this preparation at least five years before any planned exit or change in ownership.

The next tier of businesses have grown into sizeable profitable businesses of over $1-3m profits. Selling a business of this size and achieving the right price requires insulation of the business from private affairs, and an effective management team in place. This can be managed by grooming employees that demonstrate the requisite skills for management and other senior positions. The requisite skills must involve having the cultural and personal attributes to sustain/grow the business. To develop a business for sale to this stage will require significant lead up time.

To achieve a robust business at this profitability does not often happen by chance and is likely to have owners who consciously review the position of the business financially, internally and externally at least on an annual basis. Considering this effort – why sell? Why not retain ownership by putting effective governance in place. Instead of investing time in grooming the business for sale, an alternative option is to groom the business for effective management focused on stability or sustained growth, and step back into a governance role with a governance team. Having this structure in place will allow the business to be sold when you choose to. Another alternative is to sell down interests over time, especially if there is a successor identified, or to sell a portion of your interests and retain a portion. The key challenge with this strategy is being able to step back and relinquish control. This can only be achieved by effective recruitment and retention strategies and compatibility with cultural dynamics of the business.

Retaining a successful and profitable business also works well with changing dynamics – people are having children later in life, are living longer, but also wanting more of a balanced leisurely life earlier. Retaining shareholding interests and governance within a successful business allows more time for the next generation to mature and to make the important decisions at the right time. In the meantime effective structures are able to be put in place which allow next generations to participate in profits based on the owning generation wishes, and can also deal with succession issues post death. There may be something to be said to leaving wealth coupled with responsibility to the next generation.

In accordance with prevalent succession advice, discussions should be had with family and the purpose of any structure effectively communicated. Wills, and Memorandum of Wishes should all be prepared and kept updated. The key here is to regularly consider your succession plans, personal and familial situation in conjunction with the business annual review. With the assistance of a good accounting advisory and legal team, structures tailored to your situation are able to be put in place which will accommodate your requirements.

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events