We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

In 2023 growth still matters, but it’ll be hard!

The Annual Enterprise Survey is out – it measures the financial performance and financial position of New Zealand businesses. I commented on the same survey last year (click here to read it) and it proved yet again to be an interesting read on what is and isn’t thriving.

The survey provides insights into what your business should be aiming for on a couple of key operating metrics. Knowing what others are achieving helps with realistic goal setting and inspires your team to do more than average.

Having goals and a plan to achieve them in stormy times is important, communicating those achievable goals to your team is important, and developing high-performing teams that are focused on goals is fundamental.

Growth is important for achieving human engagement, without growth (short of shooting all the old people), personal progression is difficult to achieve in an organisation. But it’s the external growth and new challenges that create knowledge in the workplace.

2022 in review

In 2021 I thought, “Next year will be a year of managing capacity, trying to match it to demand, trying to move inventory on, and managing cash and debt far more.” And then…

The labour scarcity continued, and rationing of resources to customers, be it eggs, potatoes, advisory time, or getting trades to do stuff, was a theme. Bank credit tightened noticeably and businesses had to focus on maintaining cash flow.

2022 was a year that many are glad to see the back of. Everything was hard. The biggest risk in 2022, was boredom and frustration.

I thought that post the lockdowns of 2020, many businesses would open for Christmas and just fade away in 2021. That didn’t happen, in either 2021 or early 2022. They wobbled on, but late in 2022 a few long-term retailers in Wellington made the news announcing they were selling their stock and shutting.

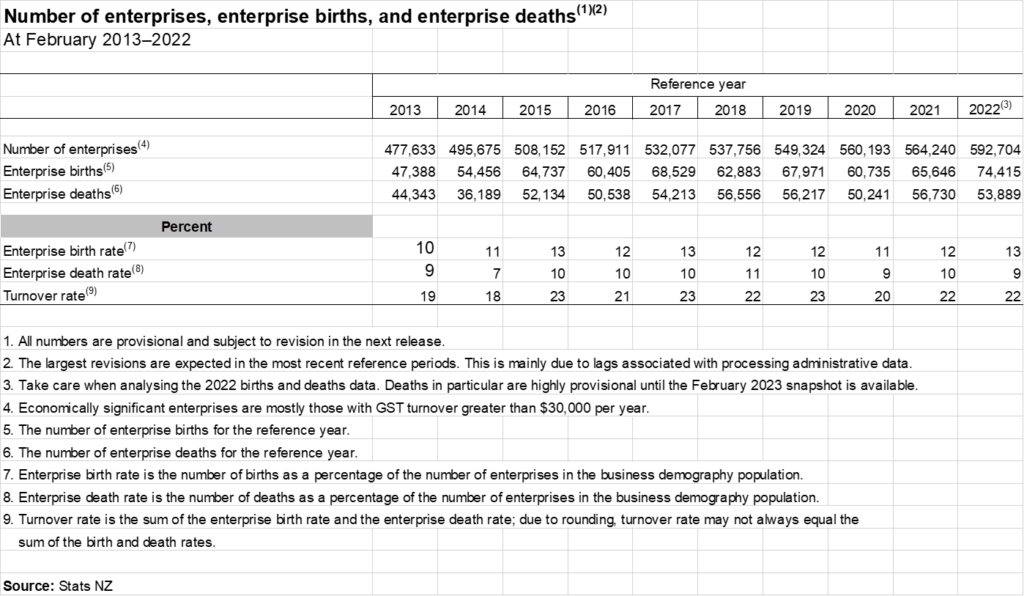

It was interesting to note that the growth in enterprises rose in 2022, showing that people are still trying. Also, during Covid (2020 and 2021) new enterprises slowed and failure rates declined (no surprises, we were locked up). This indicated to me that the wage subsidy saved businesses that would have failed. The manipulation of the destructive capitalism process by the central government was that 13,000 businesses that should have failed, were rescued. Certainly, without the subsidy, the enterprise death rate would have increased.

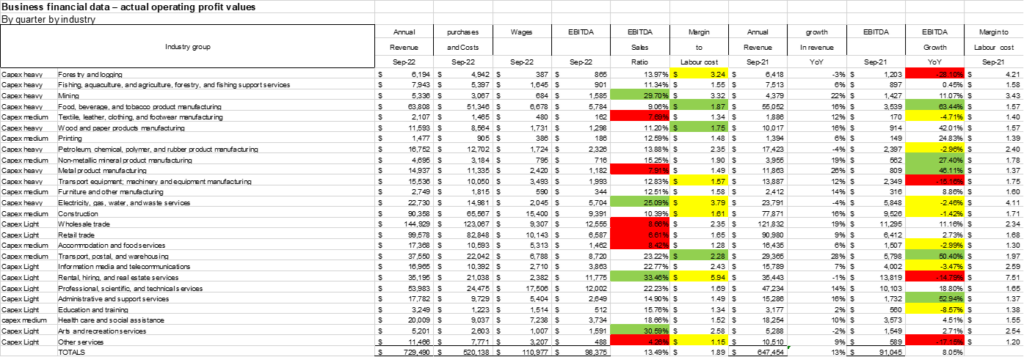

Set out below is an extract of the September 2022 enterprise survey.

The orange flags in the September column were the sectors under stress at the end of 2021. This was cassessed based on declining sales and profit, combined with weak operating margins. Under “industry group “ which is the September 2022 setting, Green is favourable, orange is under stress or vulnerable, red is highly stressed. So much for my predictions!

- Printing and furniture manufacturing managed to recover for some inexplicable reason.

- Non-metallic manufacturing is favourable, but only due to exceptional growth, which is probably unsustainable and is the Covid lag effect.

- In the last quarter (September 2022) inflation data, transport-related costs inflated by 18% in three months! De-aggregating our GDP numbers for September 2022, the transport sector’s contribution to GDP increased by a whopping 22%. This might explain the favourable economics of transport.

- Petroleum, chemical, etc. have recovered to neutral simply because the margin and volume declines have reduced, still on balance unfavourable.

- The transport equipment and the equipment manufacturing sector has moved to highly distressed, and I must wonder if the margin of decline and revenue issues are related to the need to reduce inventories identified in 2021.

- Food and beverage recovery resurgence are also understandable on the high inflation levels.

- Agriculture and fishing are obviously having their margins and their fundamental economics eroded. Our drive to have chickens at home, food treated as pets, trying to stop cows farting, subdividing land that should be cropped, and driving up labour costs while also making it hard to get seasonal workers to pick fruit and harvest crops is making this sector uneconomic. The sum of all these factors in terms of the economic viability of this sector is probably greater than the effects of climate change, but who would know? The sector is now highly distressed.

If strategically we can’t feed ourselves, we are in serious trouble! If food becomes unaffordable for the majority, no one will care about tomorrow. As I have always said, worrying about tomorrow and climate change is the prerogative of those in a comfortable armchair today.

What did businesses look like in 2022?

Here is the data. Source: Statistics NZ.

I have the view that any business with 9% EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation) margin or less, will suffer considerably when revenues fall, especially if much of their costs are fixed. Thus, all with margins of less than 9% I have highlighted as vulnerable.

Under the heading margin to labour cost ratio, if it is green, they have improved their margin on last year, yellow it has deteriorated moderately, and red significantly, likewise for EBITDA margin movements.

Where the EBITDA margin is 9% or less and the margin on labour is less than $1.50, the business is highly vulnerable to revenue falls. Why is the margin on labour important? Mostly because it is relatively fixed, and increasingly hard without significant trauma to reduce and it is a measure of labour efficiency.

So, to benchmark yourself, pick up these three key metrics…

- Revenue YOY growth rate (average across the whole economy 13%)

- EBITDA margin (average 13%)

- EBITDA plus wages divided by wages ratio ($1.89)

If you are beating the averages across the whole economy, congratulations, you are making money. If you are not, you are probably at risk.

If you would like to send us your financials from last year,

we can complete a business health assessment for you (email: bruce@gilshep.co.nz)

Setting business targets for 2023

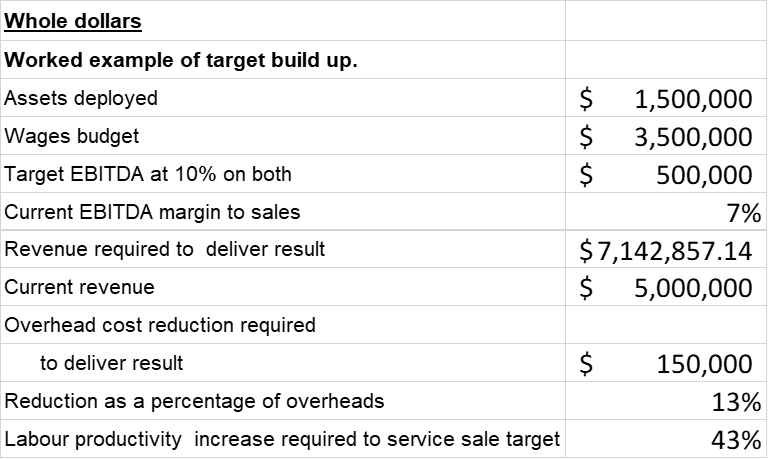

Obviously producing a high EBITDA margin on a low volume does not make a business profitable, so clearly relative to capital deployed and labour engaged, there should be a revenue number that justifies the risk and aggravation. What should that number be in your business?

The 2022 data on total assets is not yet available. Total assets across all business assets and all business in September 2021 were $2.5 trillion. These were the assets committed to supporting the enterprises that operated through to 30 September 2022. These enterprises in aggregate made $98,375m. That equates to a 3.92% return on total assets. Total assets would include all working capital whether funded by creditors or not, plus all fixed assets used to make the products and support the services offered by the enterprise.

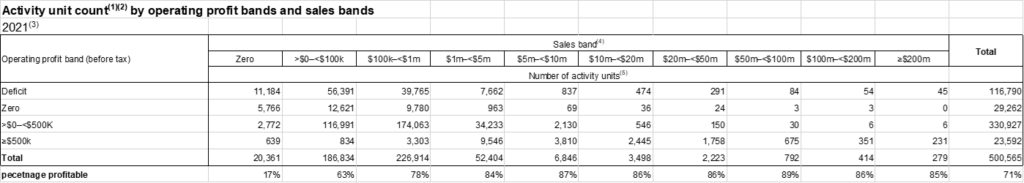

Included in this average, are businesses that lose money or make no money at all. It might surprise you to know how few businesses make more than $500k pa, and how many lose or make no money at all. It may also surprise you to know that scale is not an insulator to loss. In fact, the percentage of businesses turning over more than $200m that make losses or zero is the same as small businesses turning over less than $5m.

The purpose of this digression is to point out that a 3.92% return on assets is derived after taking out the losses of 29% of the cohort group so at the least the target should be uplifted by 29/71 to arrive at a 5.52% return on assets. It is also worth noting that you can get a long-run average return on total assets at an operational level out of listed public companies of 8% pa, so why would you deploy capital in a private business for less! So let’s say a realistic target return as a baseline should be 10%.

Picking your number is your business and the return rate should correlate with the replacement cycle of your assets. Long-term assets that depreciate require a higher rate of return than assets that hold their value. But what return or margin should we make on the cost of labour? If we truly regard people as important as capital, whatever return on capital we derive should surely be matched by a return on labour.

Here’s a worked example:

The art of planning the coming year is a stock-take on where you are in absolute terms and relatively, a clear statement of where you want to go, and plan to get there. Growth beats the hell out of contraction, but growth is going to be hard, so it is a series of trade-offs. The obvious trade-offs, being contraction of overheads, or the whipping of people to do more. Finally, and whatever route you take you need the courage to lead the team and cohesion not to deviate.

Executing plans despite what 2023 has in store

We know inflation is running at 7%, fruit and vegetables are up 17%, rates 7%, transport 18%, and credit services 6.5% in the last three months! Likely that is coming off a bit, however, interest rates will continue to rise for at least another four to six months, then plateau, and most likely start falling by the end of the year.

Unemployment is constant at 3.3%. More women than men are unemployed, who knows why. This has persisted since post the GFC. Pre that, no real divergence on gender. Unemployment is likely to rise this year.

GDP is up 2.7% in nominal dollars, taking off inflation and in real terms, the economy shrank 4.5%. Don’t let them fool you into thinking we are not already in a recession.

2023 is going to be slow, and it will be hard to grow. But growth is of the utmost importance to your team and your business. The adage is, “if a business is flat lining, in medical terms it is… dead.”

My advice: same as last year – hold cash and avoid debt.

My warning: usually, I’m the one pulling crazy antics to get results, but now it’s everyone else, I’m the only sane one in the room, not exactly my comfortable place! I put it down to the pressure cooker we’ve experienced, the side-effect of losing our freedom. And there’s no anecdote for crazy, stand aside and just get out of the way.

My prediction: We’re running up to an election and the focus will be on the middle class. There will be panic and poor leadership (such as the government making decisions to close all schools due to flooding). Interest rates will start falling from mid-October and unemployment will start to strongly rise this winter. The people these things affect are our workforce – they are whom you need to focus on and look after. Team dysfunction and leadership failure are the biggest risks.

- Understand your business and how it compares.

- Build a plan for growth.

- Develop your team and their leaders to carry it out.

If you need guidance with any of the steps above, reach out. We can help with a business health assessment based on your business and its numbers, strategy development, and leadership alignment.

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events