We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

2022 – a new year, a new challenge

Firstly, no one knows what will happen in the future, and the doomsday merchants are always right eventually. My guess is, 2022 will be a year of adjustment. As we leave 2021, a few economic stats admittedly harvested for my narrative to think about.

Government debt now stands at $102b which is its highest level ever. No surprises there. We have onboarded over $50b of that in two years. Again, no surprises. However, the debt has not created any compensating asset that will help to pay for it in the future. It’s all been spent on subsidies for businesses, workforce, beneficiaries, and pouring money in to MIQ and various other things related to the pandemic. Still no surprises. All well-known and chewed over by commentators.

To balance out how outstandingly shocking this seems, New Zealand has a stable credit rating that’s bizarrely improved from negative over the last three years, and sits at AA+, up from AA (in 1972 we were AAA+). The downward trajectory is gradual and much longer term than the current spendthrifts. Our debt to GDP is at 30.1% as we leave 2021, which is all good and well, if our GDP doesn’t fall too much and is still quite low by some standards. The PIGS (Portugal Ireland Greece and Spain) got into trouble once it got close to 100%, so the Government can keep this game going a couple more years before they will default on pensions and paying teachers and nurses. 2023 is election year, so a safe bet they will keep the financial stimulus going for at least two more years, and we will all be okay treading water.

The Governments’ objective was to keep the workforce in jobs (at a cost of $50b plus) in which they succeeded. In part due to subsidising businesses, but more due to closing the borders and not allowing anyone in. Capacity utilisation is at 96.1%, its highest level in 25 years and the percentage of New Zealanders working is also at its highest level in 25 years. Construction output is down significantly, understandably, and the backlog will constrain the sector and increase costs for some time.

The workers in this sector are counted as working when they are not, along with other sectors that are shut down. Obviously, you can’t redeploy a carpenter to banking, accounting, law, or nursing. Thus, while the capacity utilisation indicates full employment. It is an economy of employed but underworked and employed and overworked, with the resulting stress that comes from that.

The average GDP per capita is $39,870, so with only 72% of us in work, however they define that, this implies an average wage of $56,000. Wage inflation over the last 12 months was 3.1% on average, and price inflation was 4.9%. While the Government has increased the number of New Zealanders working, it has in real terms, reduced the income per worker. Also note some of the highest paid workers are in Government, but alas, not the front line that teach our kids and look after our health. An institute of Chartered Accountants survey found that Government employed accountants, including partners, are paid more than CAs in public practise, and so for that matter are CA’s working for charities. Corporate pay remains the highest but the gap with Government is closing. Corporate Accountants still work the longest hours, but now so do Government Accountants. There is a lot for these Government employees to jaw-nash over, it would seem. This is the classic hallmark of a “peoples revolution”. The socialists pay themselves more and drive everyone else’s income down. Read Orwell and Animal Farm for a parody on the great peoples state of Russia in the 1930’s. I digress, sorry, couldn’t help it.

So, what do businesses think about all of this?

Well, business confidence is a net negative sentiment of 20%, not as bad as the GFC when it was negative 60%, but it has been tracking down for three quarters now. Also, business inventories have been building up strongly, the fastest and largest build-up in the last 25 years. In fairness, for those that had cash facing inflation and supply chain disruption, it wasn’t the dumbest thing in the world to do, if you assumed that the world would revert to normal. Then you would run your inventories down cashing in on the higher prices while also being able to improve your competitive advantage, and market share as against those that had stock outs. Certainly, I advised clients to do just this, and certainly companies on whose boards I sit did this to their advantage. What this tells me, is the cash that has been poured into business has been used to pay wages and make or import shit that is sitting on the shelf unsold. Now, the only good news is this… business lending is substantially unchanged from pre-Covid at $121,974m as at 31 October 2021, and the last 12 month growth rate in business debt is 4.5%pa. In short, the inventory build-up has been financed substantially with equity and cash flow which includes Government subsidies.

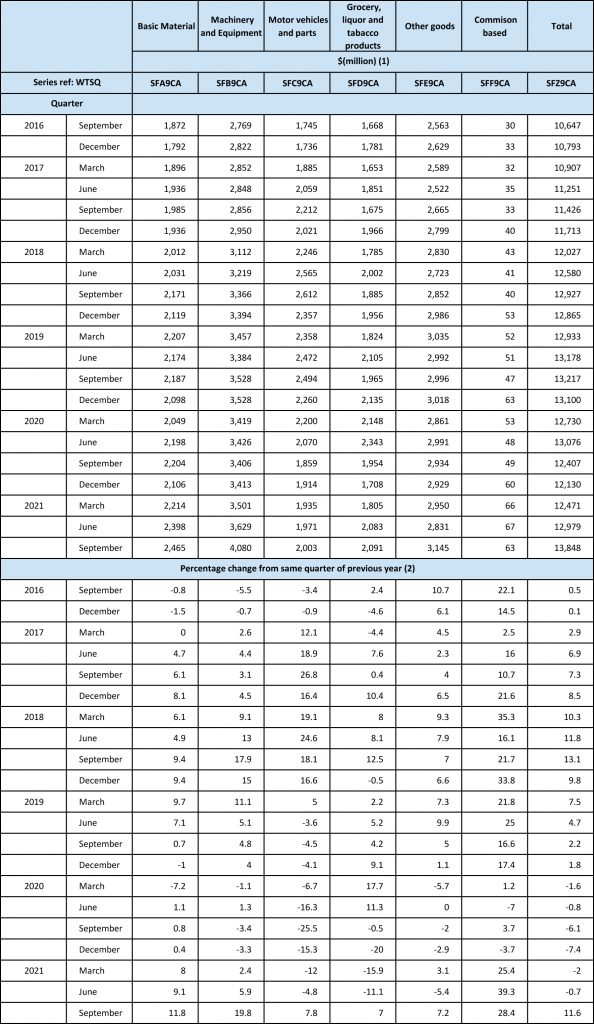

Set out below, is a table of inventories at the end of September 2021, and the changes over time since records have been maintained.

The major build-up has been in basic materials and machinery that will include several sectors of the economy that are under stress.

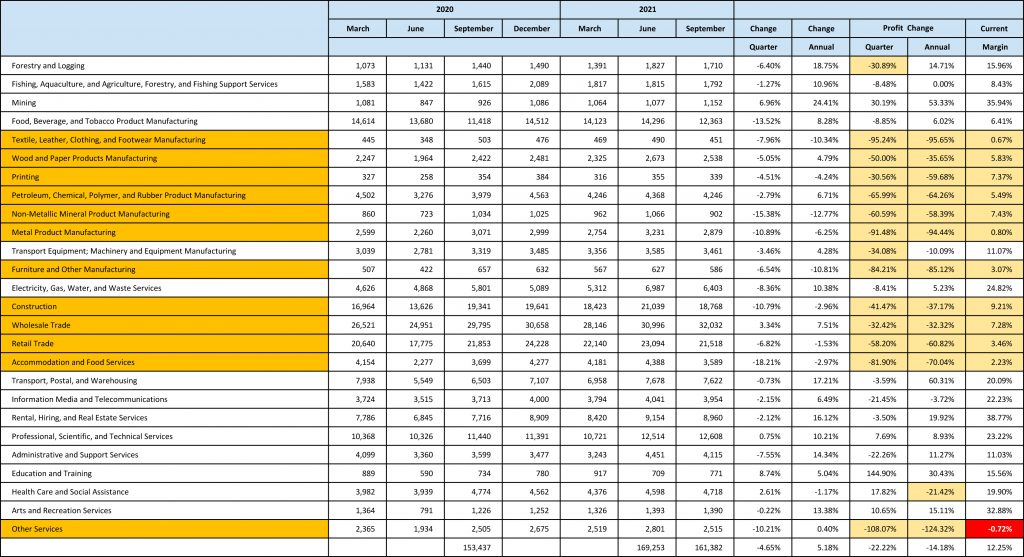

Set out below is an extract of business performance to the end of September 2021, taken from Statistics New Zealand.

You will note that the fast inventory build-up has been within the industries that have had the fastest falling revenue year-on-year, and are currently operating on the slimmest margins. These are well known as being distressed by lockdown, nearly 60% of the total business sector as assessed by revenue to those businesses.

Clearly, ultimately it is households that will buy that inventory, turning it back into cash in the businesses that hold it and thus freeing them to buy more inventory – so here is where housing becomes important.

Total consumer debt at the end of October 2021, including house lending was $329b. The growth rate in the last twelve months was 11.4%. Household debt is up $52b in the last two years, and Government debt nigh over $50b. The problem is going to be household debt and interest rates. When these bite spendings slow (unless the government decides to continue subsidising consumption and lifestyles) it becomes ironic that, it is consumption that fuels carbon emissions!

The only thing that is new in all of this, as most of the other statistics in isolation have been well discussed, is the level of inventory build-up and the impact it will have on business and employment levels if that inventory becomes Illiquid. That hasn’t really been thought about.

So, indeed 2022 will be a different year to 2021, where the aggravation was not being able to work effectively and will likely be extremely ugly unless Government intends to continue spending significant sums on supporting businesses.

This year will be a year of managing capacity, trying to match demand, move inventory on, and managing cash and debt far more than we have had to do previously, as we swam in a sea of fiscal stimulus that our children will have to pay for.

We will have to adjust to the new normal of remote working, fractured teams, rising uncertainty, and increased stress levels of our own and our teams, all to keep our businesses open.

If you thought last year was tough, well 2022 may well be even harder. As the pain spreads, as it seems it must, to the wider economy beyond retail hospitality and tourism; keep walking, stay alert, and be prepared to adapt and pivot quickly.

Remain calm, and if you are a leader, protect your people. Don’t be afraid of just standing still if you must, the survivors will inherit a rich bounty. These are the scariest of times, the most exciting of times and times with immense opportunity.

2022 will be different, be vigilant and prepared.

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events