We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

How do you judge the value of a service contract?

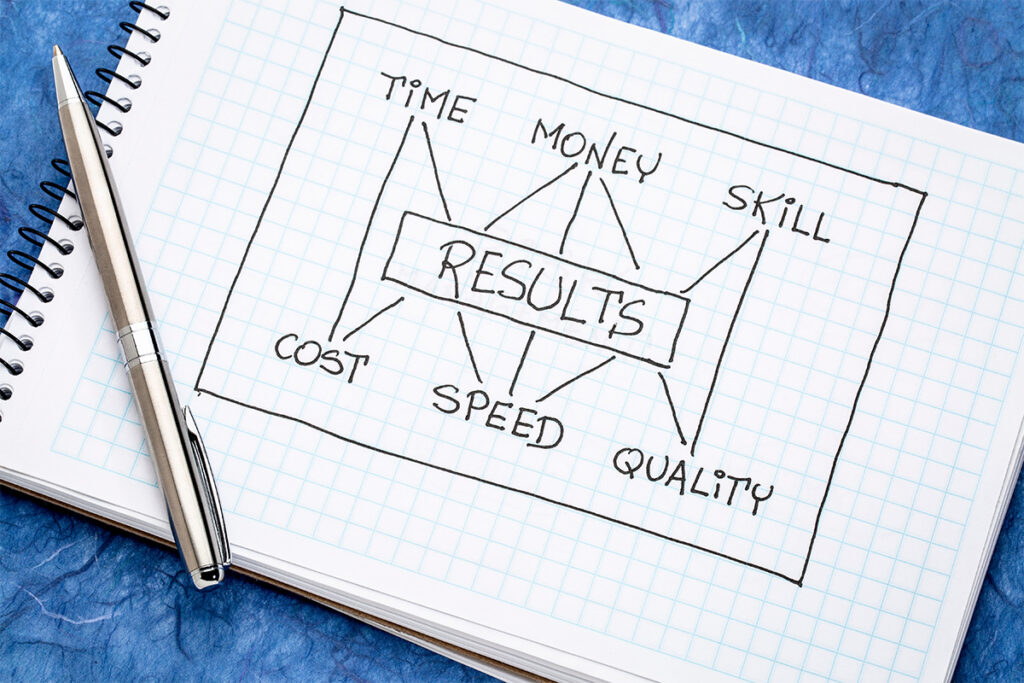

The adage is that the value in all transactions is a trade-off between price, timeliness, and quality. A customer wants cheap, fast, and good. But a supplier who attempts to deliver all three will struggle to sustain their operations and are more likely to fail eventually, and usually in the quality component because that is the easiest to hide for the longest time.

In writing this, I am conflicted as GS is a service provider. Thus, you can be excused for thinking I will focus on things that make us look good. I won’t, but judge for yourself.

I also serve on numerous boards and purchase accounting and advisory services from others in those companies. Some I use are from the big four firms, mid-sized firms, firms of GS’s size, and occasionally, very small firms.

By the way, value doesn’t always come in a holistic sense based on the size of a firm. All that can be said against micro firms (in a human sense) is that they are not always as sustainable as slightly larger firms. I tend to favour firms with at least three partners – why? because many eyes and stakeholders mean less of a chance of fraud (admittedly rare), and it also gives survivorship if a partner dies.

Price and timeliness are easy to judge in the value equation, but with services, it’s hard to judge quality. It’s not a device or physical product you can touch and feel – it’s a sense, a feeling, more than a tactile measurable.

I will now focus on accounting as a service…

The first critical ingredient to quality is the supplier’s experience. So how do you judge that as a customer?

I know this might breach the human rights act, but age… Has the firm got around one-third of its team over 45? If not, they may not have enough grey hairs or have seen enough to smell the breeze quickly. Have they also got at least 20% under 30? If not, they may not have enough emerging talent and current knowledge of basic compliance to deliver the basics in today’s world.

If the firm lists all its people on its website and allow those people to tell their stories, is there a diversity of experience beyond the subject matter of accounting? And are there a few years of professional experience from outside the firm? It’s easy to fall into complacency if they’re not rejuvenating and bringing in people with different experiences to grow each other’s skill sets.

You are now engaged with them…

Now you’ve met, how many people were present? Just the partner, or do you meet the full team who will be doing your work? Do you get a sense of the diversity of experience and mutual respect with eachother? To deploy the experience effectively when completing the work, ask them how the file review process works.

How do they communicate with you? Do they ask questions? If they see declining cash reserves or declining or rising margins, do they call and ask you about this?

Why is this important? Because mistakes can be made in classifying expenses as assets and vice versa. Drawings and expenses will distort the margin, and such activity exposes you to risk with the IRD.

If you ask them to do something that might be risky, for example, treating a holiday as a business trip, do they challenge you and explain why they won’t do such a thing? Do they tell you “No”? It’s hard for accountants to commit to quality without them challenging you and having boundaries over which they will not cross.

Mistakes are not necessarily due to a quality issue; sometimes, it’s just communication. Humans are all frail and thus occasionally fail. The ultimate test of commitment to quality is how a firm responds to problems. Do they fess up? Is your accountant the first person to tell you about it? If so, they are committed to owning mistakes and fixing them, ensuring the quality of what they do is guaranteed. If, instead, they try and bury them, well, you know how that ends.

It’s hard to be objective when dealing with mistakes and failures. But do they fairly and rationally push back on your contribution to the mess? If not, they likely don’t have the confidence to back themselves. Often this is because they are already dealing with several mistakes, or the firm lacks the scale to stand back from the noise and objectively examine what happened with a third set of eyes.

Funnily enough, your best test of a firm’s commitment to quality is having them fail and see how they resolve it and how rational they are with you.

Most firms fail at this last hurdle, and maybe it doesn’t matter (unless your engagement is the cause of mistakes). I know this because new clients come to us not because of another firm’s mistake but because of how the firm handled the mistake.

So, generally speaking…

Look for firms with a mix of seasoned professionals and emerging talent. Consider the diversity of experience and whether they openly expose the team. Communication is another key factor. A quality-focused firm will ask questions, challenge risky requests, and take responsibility for mistakes. Their response to problems reveals their commitment to fixing issues and ensuring quality. A firm’s ability to handle and resolve failures rationally is a true test of its quality. Assessing the firm’s size, demographics, outside experience, and communication style will help determine the level of quality you can expect.

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events