We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

Why Xero?

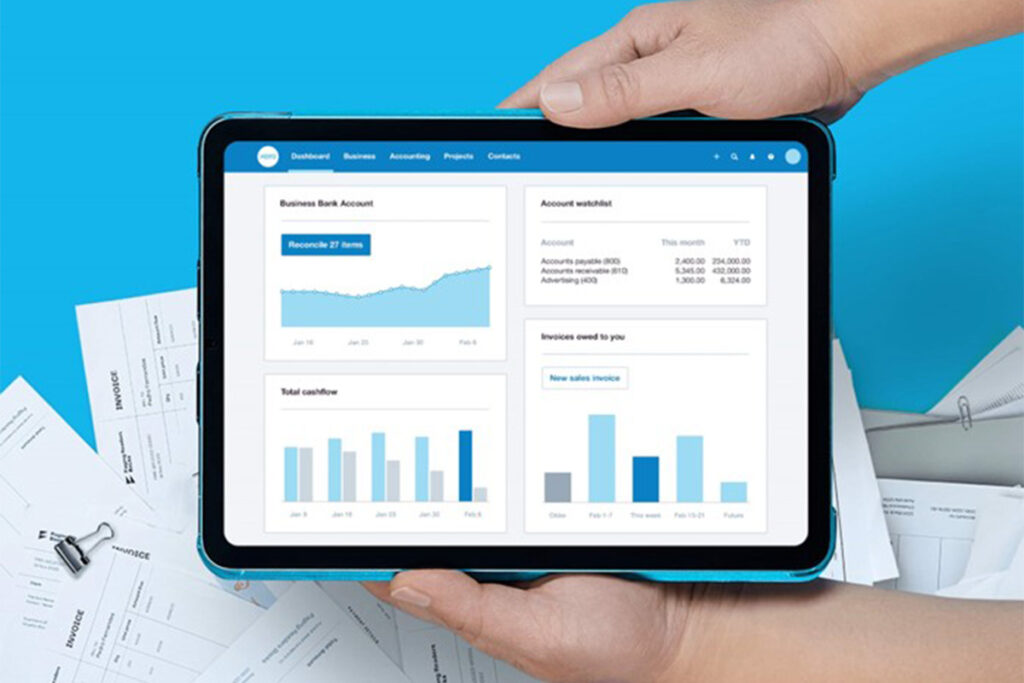

Managing finances efficiently is key to the success of any organisation. With many accounting software options available, it can be challenging to find the right fit. However, Xero has proved to be a powerful, user-friendly solution, revolutionising how businesses handle their finances. Let’s explore Xero’s features, benefits, and why it should be your go-to solution.

Features and Benefits of Xero

First off, Xero is all about making your life easier. It syncs with your bank accounts, handling things like importing and categorising transactions. No data entry means reducing human error and increasing free time – you can focus on the things that matter most to you.

With automatic bank feeds, you can monitor your income, expenses, and available funds in real-time. Think of it like your personal assistant, keeping you in the loop and making sure you’ve always got control over your cash flow.

Getting paid on time is just one of those things that should never be late. And Xero knows that. They’ve made it super easy for you to manage your invoicing while creating professional-looking invoices that offer multiple payment options (if you choose) so that you look great in front of clients. Faster payments mean a healthier cash flow for your business. We know how painful it can be to chase overdue payments, but Xero sends automated reminders for you to keep everything smooth sailing.

You can track your expenses by categorising them, attaching receipts and creating expense reports effortlessly (your personal assistant is back again with her love for organisation). When you see where your cash is going, you can pick up on spending patterns, which are incredibly useful when optimising costs and saving money.

One of our favorite features about Xero is that they have created a collaborative workspace where you can securely share information with your accountant, bookkeeper, or team members. You can choose who gets access to the latest financial data, which keeps everyone in the loop and makes discussions more productive. This is especially great for your accountant or bookkeeper so they can provide advice and support faster.

One of my clients has been using another accounting system for several years, but it has been a lengthy process whenever we need information from them to prepare the annual accounts. They have been paying $79.61 per month to MYOB, which does not provide features like a bank feed function, which means they have to (and remember to) enter data manually. While working on their 2021 accounts, I recommended that the client switch to Xero. They were interested, and after informing them of Xero’s features and special rates, the client was delighted to do so. The most significant advantage is that, as their accountant, I can easily access financial information by logging into Xero, eliminating the need to wait until the last minute. Win-win!

Now that you’re convinced, here’s how to set it up:

Sign up and Configure:

- Visit the Xero website and sign up for a free trial or subscription.

- Follow the setup wizard to put together your business settings, such as name, address, time zone, currency, and financial year-end.

Connect and Customise:

- Connect your bank accounts to Xero to automate the import of transactions.

- Customise your chart of accounts, invoicing templates, tax settings, and contact list.

Import and Explore

- Import opening balances if transitioning from another accounting system.

- Set up user roles and permissions.

- Explore Xero’s features, access training resources, and get hands-on experience with the software.

To wrap it up, Xero is the ultimate personal assistant for business owners looking to streamline their financial management process. It’s a no-brainer. I am happy to help you set up Xero or answer any questions you may have about the software. Get in touch here.

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events