We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

Tax Updates: 6 June 2023

Welcome to this week’s review of tax issues where Richard comments on what’s been happening in the world of tax over the past week. If you have a question or would like a second opinion on any national or international tax issues, please contact Richard via email at richard@gilshep.co.nz.

When can I claim?

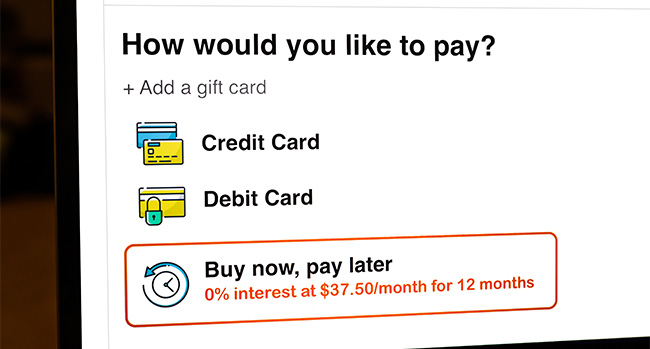

Inland Revenue (IR) has issued a Questions We’ve Been Asked, which guides on when a person registered for GST based on the payments triggers an entitlement to claim GST input tax credits on various purchase transactions – “buy now, pay later”, hire purchase agreements and laybys.

Titled QB 23/06, “GST – goods purchased on deferred payment terms”, the answer is:

- For standard sales agreements and “buy now, pay later” agreements, input tax deductions can be claimed when (and only to the extent that) payment has been made;

- For hire purchase agreements, a full input tax deduction is available when the agreement is entered into; and,

- If a person has entered into a layby sales agreement, an input tax deduction can be claimed only when property in the goods is transferred. This is typically after the final payment has been made.

I expect that most of you already appreciate that a person registered for GST on a payments basis can claim input tax deductions only when and to the extent that payment has been made. However, a couple of special rules apply when the registered person is acquiring the goods under either a hire purchase or layby agreement.

Concerning “buy now, pay later” (“BNPL”) transactions, often the BNPL provider will pay the retailer in full at the time of purchase, with the customer then repaying the BNPL provider by way of weekly or fortnightly instalments – Afterpay, one of NZ’s most well-known BNPL’s. For GST purposes, since payment is usually made in full at the time of purchase (by way of lending payment funds by the BNPL), the registered person can claim the full GST input tax credit at this time.

Finally, naturally, the registered person should only be claiming a GST input tax credit to the extent that the goods are used for or are intended to be used to make taxable supplies.

One-off payments of income – provisional tax issues

You may recall a 2019 Questions We’ve Been Asked (“QB”), which considered the potential issues for a salary and wage earner who received a one-off non-taxed lump sum of income, which triggered potential provisional tax obligations for them.

IR has now issued an update to that QB, which is QB 23/05 titled “Provisional tax – impact on salary on wage earners who receive a one-off amount of income without tax deducted”.

A salary or wage earner who receives an amount of income without tax withheld and whose RIT is over $5,000 is a provisional taxpayer, even if their RIT in the previous year was $5,000 or less. The type of non-taxed income received by the person could be:

bright-line income from the sale of a property;

- shares received under an employee share scheme (if no PAYE has been deducted);

- depreciation recovery income from the sale of a rental property;

- PIE or interest income with tax deducted at an incorrectly notified rate;

- beneficiary income that is subject to income tax; and,

- a sale of shares acquired with the intention of selling.

Should you have clients faced with this scenario, QB 23/05 outlines the following potential provisional tax

implications that they may encounter:If their RIT is $60,000 or more, they will be exposed to use-of-money interest (UOMI) from their 3rd

instalment date (P3) on any RIT not paid by P3 (being 7 May for taxpayers with a standard 31 March

balance date);

- If their RIT is less than $60,000, they will not have exposure to any UOMI interest provided they pay the RIT on or before the terminal tax date (being 7th April if covered by your EOT arrangements, otherwise 7th February).

- In both situations, late penalty payments may apply to underpayments, and the person will be obliged to pay provisional tax in the tax year after receiving the one-off amount. IR is also likely to advise your client to pay provisional tax in the next income year, which you may wish to counter by filing a nil estimation (being careful naturally that your client is unlikely to receive similar un-taxed amounts in the following year).

The QB is a 17-page document accompanied by a 6-page fact sheet.

This article was originally published through the ‘A Week In Review’ newsletter. If you would like to receive Richard’s tax updates every Monday morning, you can subscribe here.

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events