We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

Impertinent questions for economic leadership

The tyranny we have been subjected to as a nation has likely blinded us to the long term negative economic and health consequences.

The tax base has been well and truly rooted and will take a decade to recover fully. So much so, we need to ignore that ambition of getting back to pre-Covid levels. Borrowing cost levels, now while interest rates are low won’t last forever, and we are unlikely to generate the economic growth to increase tax revenue to allow the government of the day to fund day to day costs, future investment and paying off historic debt.

The best estimates of the increased debt burden suggest near $50 billion dollars in additional debt. To put that into context, the total tax/revenue for the Government in the 2018/2019 year was just a whisker over $93 billion, and they spent that and more.

While it does not fit with the kindness, hugs and head-tilt narrative of the Government, the answer to the question “What do we need to fix to allow the country to move forward?” – it’s the economy stupid.

One thing we can rest assured of, is that the next time we will not make the same mistakes that have been made at present. However, like a bad episode of South Park, we do not have a Captain Hindsight to save the day. Passing the buck to yet another working group and bunch of cardigans from Wellington will not deliver meaningful outcomes.

Our export earners need to be given real support to rebuild and increase volume. This will mean in the primary sector could be positioned to see an export boom especially if our exchange rate remains attractively low. New agricultural enterprises such as new growing methods increasing yields for cherries or the newly regulated medicinal cannabis industry, will see growth in revenue and employment.

Big business will need help, this should fit more comfortable with the left as they love big business as it is big business which employs union members who fund the labour party.

Innovative New Zealanders are being encouraged to take risks and look at reinventing public transport or moving to a green economy. The funding cost of risk has just gone up. The cost of capital will be burdened by the increased public debt, however, we will see offshore capital look for safe havens which can also provide risk/reward opportunities – unless we scare that capital away. Safety equipment and PPE imports are popular topics, I know of 12 different people trying to capitalise on importing PPE for various users – hospitals, dentists, hairdressers, baristas and bus drivers to name a few. I think a smart idea would be a business that recycled all the PPE that will be going to waste or not even used if it can be funded to land in New Zealand. Therein lies the biggest challenge ahead – funding of business, or more importantly risk.

A recent Callaghan Innovation survey has yielded not surprising results when you consider the nature of companies who engage with Callaghan. This is where we will see the green shoots of recovery:

- More than half of businesses surveyed (58%) can see an opportunity to accelerate or pivot their business model and/or R&D projects.

- 62% of businesses plan to continue or accelerate R&D work within the next six months, almost all (99%) businesses plan to invest in R&D within the next 12 months.

Cutting spending or raising taxes extends and worsens the impact of any recession, although there is easily $5b of wasteful spending that the Government and local council could remove or repurpose tomorrow.

Upon writing this article, the Government will announce the budget this week. I suspect it will be a continuation and reflection of the lack of leadership, strategy and planning for the future of New Zealand. The guarantee is we will see virtue signalling like there is no tomorrow. There are many words I could choose but muddled seems the most printable as to the approach we will see.

If you have survived, I have good news, and I have bad news.

The good news is that you are still in business.

The bad news is that it is not over yet. This is just the end of the beginning.

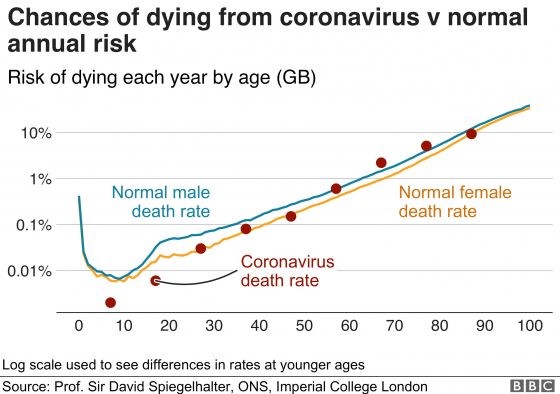

This Government is borrowing billions on behalf of future generations, not to deliver infrastructure or improved lives, but mainly to win the next election. The cure has clearly been worse than the disease and comes with a heavy economic cost. The lockdown was to avoid the pressure on the health system. The irony is that the tens of thousands of operations cancelled will take years to catch up unless those patients die off. Our hospitals are not overwhelmed, and nurses are on reduced hours. Go figure. This will turn on its head, and the health system that the government sacrificed so much to protect is going to be under significant stress over the next 6-12 months.

Basically, people who died of Covid, would have died anyway in the near future.

Level 2 is not the level two we thought we were getting. The talk of winning battles, not the war is just evidence of a lack of leadership and plan. Shameful. Six weeks in, and no plan.

So, what you should you do now?

Start with establishing your ‘business for now’ model (not business as usual).

- How are your staff – do they feel safe?

- How robust is your supply chain?

- What have you learned about your customers?

- What have they learned about you? Do they think you are tone deaf or authentic?

- What have you learned over the last 6 weeks?

- What is your new cost of capital?

- What is your working capital runway look like?

- How much longer can you last under the business for now model?

- What is your bank saying to you? Have you taken advantage of loans, or mortgage holidays? The mortgage holiday will have a price down the track.

Have a plan, sell your plan and sell your vision. That is leadership, and people will follow.

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events