We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

Opportunity knocks, and does not waste time for those who are unprepared

As we fast approach Christmas and the summer break, it makes sense to look back on the year and then look forward to the year ahead.

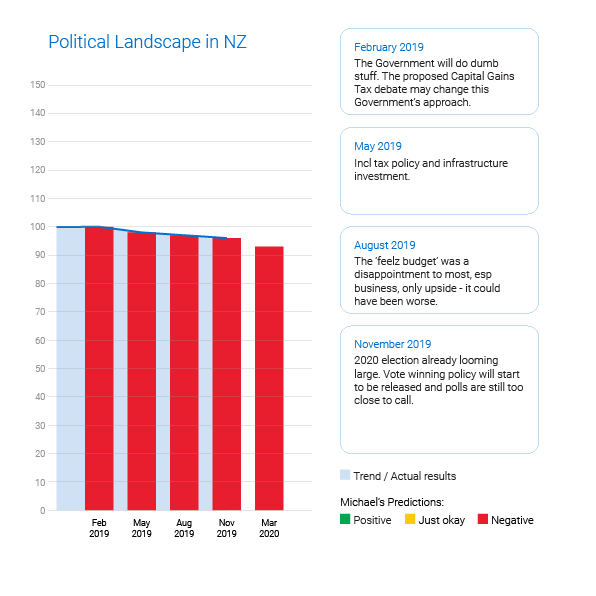

A number of the key economic indicators both local and international suggest we are in the Goldilocks zone, and with the impending election in 2020 what should your business strategy be considering?

- Do we invest in growth?

- More staff?

- More debt?

- Do we retrench?

- Do we restructure how we do business?

Our economy is not too hot or cold. We have moderate growth and low inflation. Without getting into a debate on Reganomics vs Keynesian economics, history tells us that during these times business generally can take advantage and set a course for the next two to three years.

Locally, the Goldilocks metaphor can be applied to the way the Government has looked at the Ihumatao. Like the protestors, Goldilocks naively invades the home of others and uses their private property as if it were her own. The victims, aka the bears do not violently retaliate, and the taxpayer ends up paying for houses to NOT be built. That’s a great way to help with a housing shortage/crisis, but guess it’s only a crisis when in opposition.

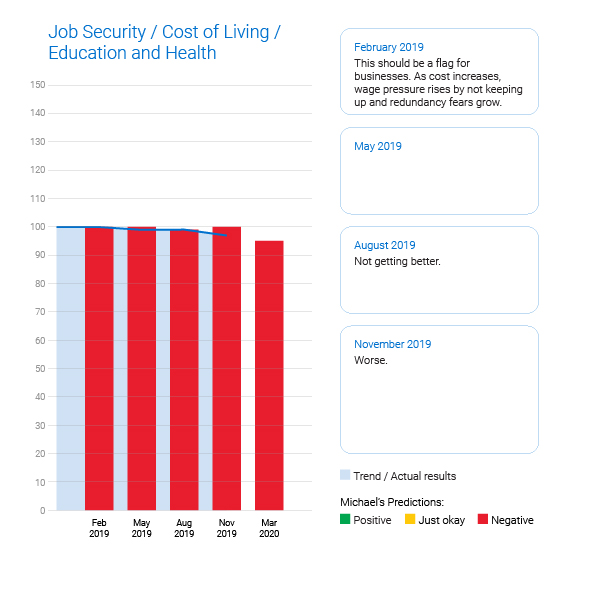

Unemployment is at historical lows (except in the Taranaki where they are facing life without the oil industry), while the cost of living is up and interest rates are low. Despite the electioneering bluster, immigration continues almost unabated, increasing the size of our local consumer base and taxpayer base.

As we enter 2020, we are already seeing the jockeying and election bribes/baubles being promised. Seems earlier than usual, so either bad news for the Government is coming, or a snap election? Most likely another baby or wedding story in the Woman’s Day.

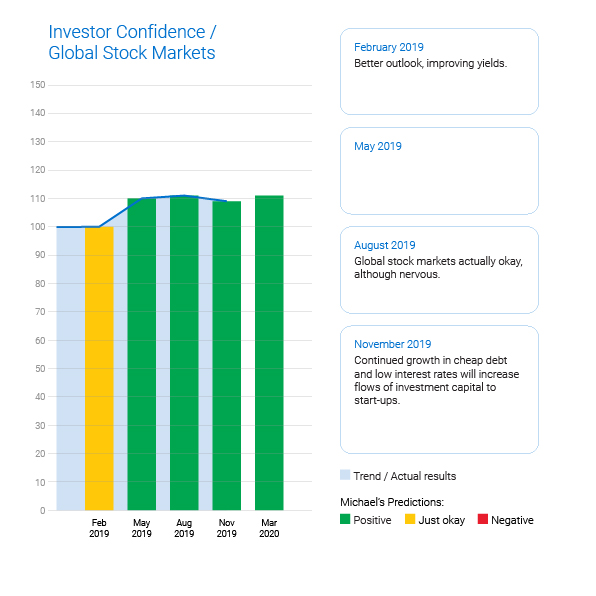

The global economy has seen total debt surged by US$7.5 trillion in the first half of this year alone, reaching a record of US$251 trillion. When debt numbers get so big, people start talking the ‘R’ word. Sure, debt is growing in the developing nations who are trying to export their way to prosperity, however it is the US and China still driving most of this debt. Some commentators continue to express concern with forecast economic growth in China to fall below 6%. With so much uncertainty and cheap debt businesses need to manage and plan carefully their own business and understand the drivers in their customer and suppliers markets. These economic conditions are ripe for the next big technology to transform our fortunes.

The Artificial Intelligence (AI) bandwagon seems to be taking over from the cryptocurrency position as chief technology of the future. If you think about it, there is quite an irony in that statement (emails to michael@gilshep.co.nz if you can explain that irony for a prize).

Our trading partners in Asia are doing better than expected, and the Hong Kong unrest has only caused localised bruising (no pun intended). The influence of China in the Asia Pacific continues, and increasing levels of Chinese Debt is being used to develop infrastructure. This is not a new phenome, and is similar to the 1980’s when Japanese trading houses ensured the Japanese heavy industry continued to thrive by providing cheap funding to buy Japanese goods.

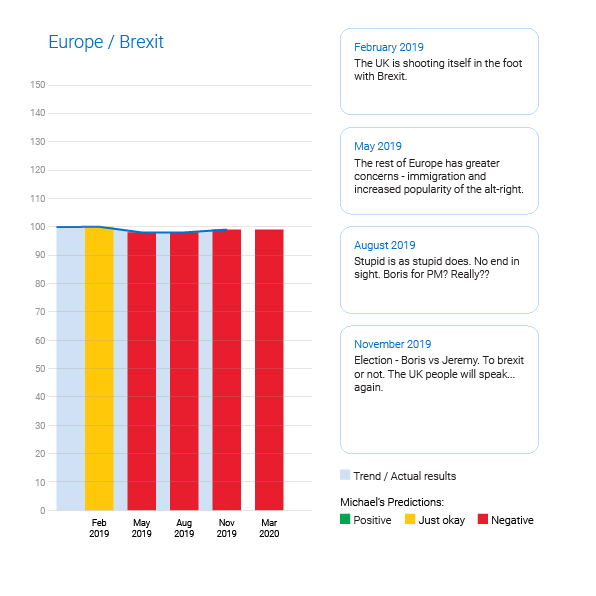

The UK/Brexit/EU saga continues, and I am sure we have now reached the end of the beginning. Regardless of the outcome in the December election, the EU will be more concerned about the German economy. For New Zealand, opportunity will be knocking in one form or another.

The US economic performance continues to be over-shadowed by the Trump re-election or his impeachment battles. Whatever transpires in January, it will be entertaining, almost like a reality TV show. The US Fed Rates are at 2.25%, which is above the healthy funds rate of 2% which will provide some comfort to borrowers in the US.

“It doesn’t matter which side of the fence you get off on sometimes. What matters most is getting off. You cannot make progress without making decisions.”

Jim Rohn

In business, as in life, an independent view of the time to jump can be helpful. What is your strategy to journey through uncertain times? Do you know if you like your porridge too hot, or too cold? Do you know what just right looks like?

Start 2020 with a discussion about your market, your business and your future with the Gilligan Sheppard Advisory team.

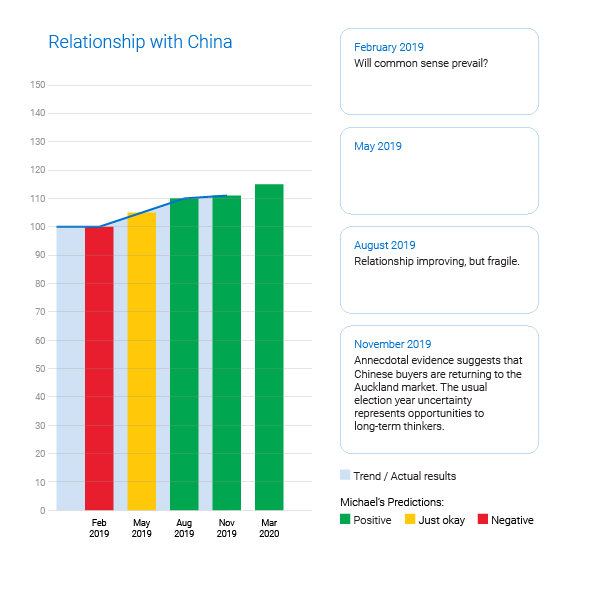

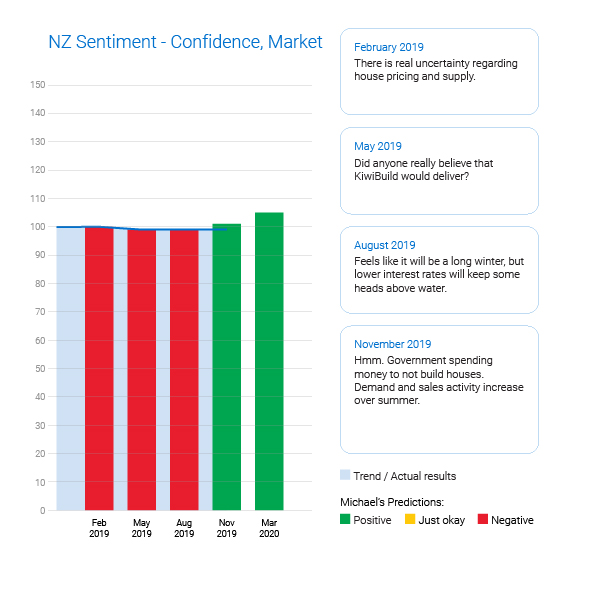

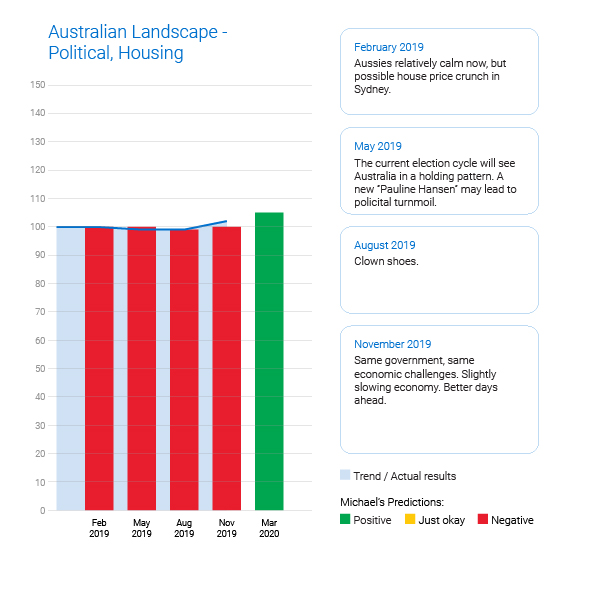

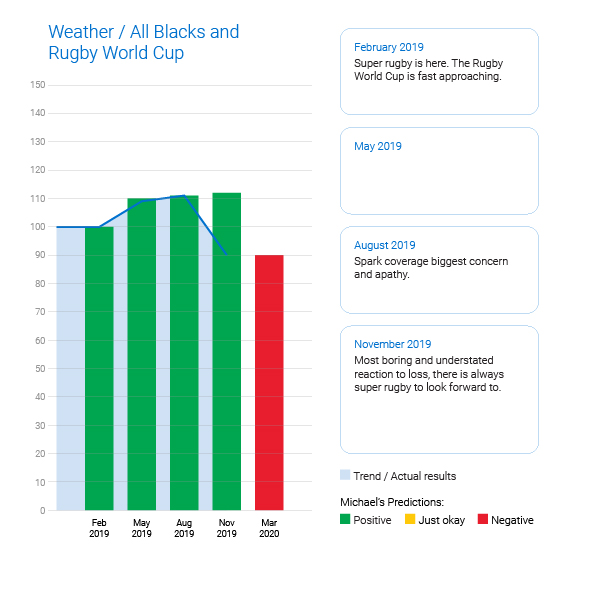

Click on the graphs below to see Michael’s predictions compared to the actual results and his forecast for March 2020.

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events