We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

Michael’s quarterly view – winds of change?

Winds of change? Build a wall or build a windmill?

“Be not afraid of going slowly. Be afraid only of standing still.”

Old Chinese proverb.

This article is the first in a regular series of observations that will attempt to provide insight into the current economic and geo-political environment and provide a snapshot as to what is happening which may have an impact on business. The following is opinion based on various factors deemed to be influential. Often analysis is given a flash acronym e.g. PESTLE (Political, Economic, Social, Technological, Legal and Environmental factors) or SWOT (Strengths, Weaknesses, Opportunities and Threats).

As part of this opinion piece I will outline some interesting factors and geo-political events/developments and then provide an opinion as to what it may mean. As you would expect, these are just opinions and food for thought, or not. As to context, economically speaking I have been influenced by Smith, Keynes, Malthus and Kondratiev (but don’t read too much into that).

Why do this now?

Most businesses are setting budgets, strategy and focus for the year ahead, reviewing their previous year, what worked well, what didn’t, etc. What will you do that’s different in FY 2019/2020?

Methodology

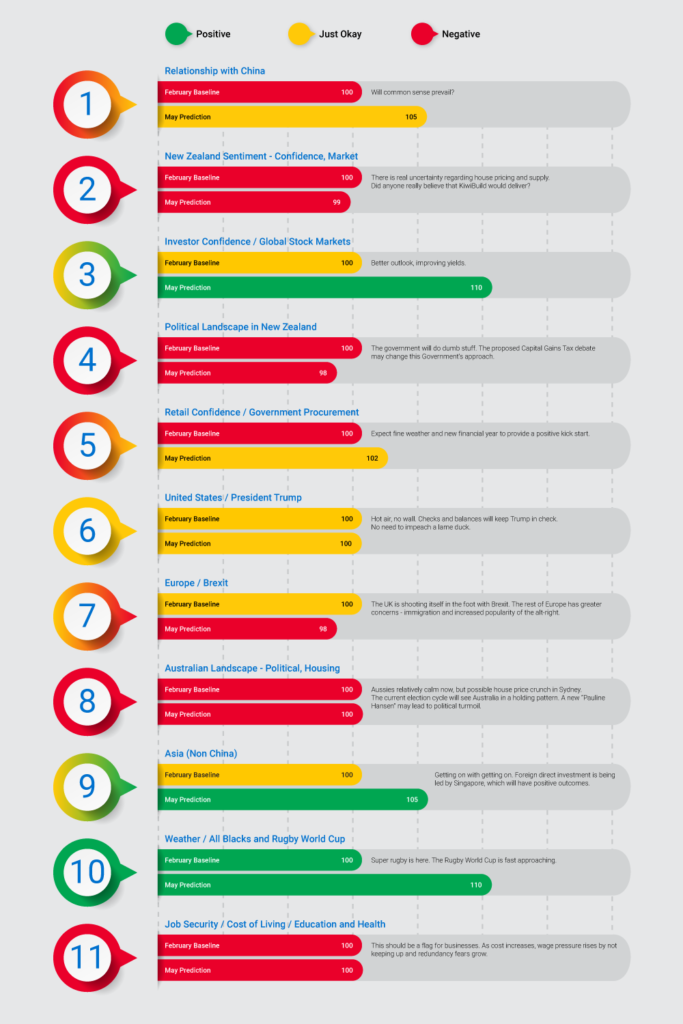

I’ve looked at various factors including local sentiment and international factors and sentiment from various sources. We have then made assumptions as to importance and influence and, hey presto, an index we can report and make comparisons over time.

Elements

- Relationship with China

- New Zealand Sentiment – Confidence, Market

- Investor Confidence / Global Stock Markets

- Political Landscape in New Zealand

- Retail Confidence / Government Procurement (e.g. NZDF, NZTA)

- United States / President Trump

- Europe / Brexit (deal / no deal)

- Australian Landscape – Political, Housing

- Asia (Non China)

- Weather / All Blacks and Rugby World Cup

- Job Security / Cost of Living / Education and Health

March 2019 Observations

Globally, investors are re-evaluating risk and return, especially when it comes to real-estate, but not so much with commercial property. International equities are still in the goldilocks phase, which history tells us, means that changes and swings are unlikely to be cataclysmic in nature. Local listed entities will not be exempt from shocks, boards are likely to become more reactive than proactive, expect to see changes with local CE’s and board positions. In breaking news – the Mainzeal case is likely to increase board sensitivity about risk and solvency, which may slow major decision making.

The lack of certainty about what the NZ Government will or will not do continues. This Government does not move with alacrity, and priorities appear to already be looking toward the next election so expect more virtue signalling and/or the start of vote buying policy. Much more vapour will be expelled over the CGT. An immediate negative consequence has been a slow-down in government infrastructure investment, and government procurement.

The general vibe in New Zealand in World Cup year is typically optimistic. Depending on the outcome of the Rugby World Cup in Japan later this year, we could potentially see a mood for big change, especially if Ireland or England lift the William Webb Ellis trophy. Caution in local business strategy for the next 12 months will likely see concerns in job security during times of increased living costs. That is not a great recipe for domestic industrial relations, expect more strike action and little gain.

What does this mean for next three months? Next six months?

As a business driver, do you know…

Where do your businesses customers live?

Where do your customers get their capital and funding, and what does that cost? This will influence their risk taking decision making if the cost of capital is asymmetrically increasing compared to their deemed competitors.

The good news is that Asia (excluding China and Korea) moves forward, and foreign direct investment continues. Singapore, over the last 12 months has invested NZD$6.4 billion in the region as Foreign Direct Investment, those chickens will come home to roost. The NZ/China relationship is critical to New Zealand’s economic prosperity for many sectors, ranging from tourism and education to primary exports to property development. The current fracture in the relationship appears temporary, and there are no signs of NZ business abandoning or diversifying away from China business or Chinese investment. New anti-money laundering rules and requirements may have a greater impact on house prices than LVR rules in the short term.

Other global players are experiencing change, the UK/Brexit and Europe relationship continues to defy all logic. We are less than four weeks from the UK exit from the EU, and despite the political uncertainty most businesses have at least thought about a Plan B, even though the political leaders have failed to deliver any reasons to rejoice.

Trump and the US continue to make great headlines, and the long signalled impeachment is less likely to occur now that the Senate and Congress have the checks and balances the US system relies on. The memes of ‘Donald the Lame Duck’ will no doubt start to hit the fake news media. Never underestimate the US consumer, however potential trade rub with China creates risk and opportunity as far as the US market is concerned. The North Korean side-show continues like a bad episode of the Simpsons.

Closer to home, all signs point to a housing price adjustment in the Australian market, led by the overheated Sydney market. The cost of new capital remains steady, especially for high growth companies that are not minerals and resources focussed. The Australian political landscape appears to be relatively settled as they approach their 2019 federal election cycle, the chances of the Wallabies winning the RWC are slim at best, and the Australian cricket team is still a shadow of its former cocky, arrogant, winning self. Australian business community confidence has lifted from near a near three year low. Has the Australian economic outlook turned a corner? If it is a dead cat bounce*, then that will flow onto our shores especially for NZ companies owned in Australia, and more importantly it will have an impact on the Australian Banks attitude to NZ business. In recent times, the subject of appropriate lending criteria has been raised, possibly due to recent litigation in Australia targeting unaffordable lending by a leading bank.

Summary

People will always be worried about something – seems to be the natural state. Modifying behaviour to a fear is what matters.

We are facing a degree of domestic uncertainty. Expect more union action, and wage pressure – may lead to inflation, and impact on interest rates unless housing sentiment weakens.

If the machinery of government was a car, an oil change is needed to avoid engine seizure. The tinkering to date, may inadvertently see a wheel fall off by the end of the year.

Businesses need to plan to be better, improve execution, less time managing via rear the view mirror. Eyes need to be on the road ahead. Expect CEOs to be replaced, expect new board appointments on listed boards, eyes will be on the key NZ economic indicator of the Fonterra pay-out, and any movement over next three months. This will drive sentiment and behaviour.

So running a business in New Zealand, what should you be thinking about? Measuring investment opportunities. Shorter term feels more realisable than longer term now. Is this any different to 12 months ago? Sentiment is important, i.e. not what you think you will do, but what do you think your competitors will do.

* A temporary recovery in share prices after a substantial fall, caused by speculators buying in order to cover their positions. For example, ‘is the recession really over, or is it a dead cat bounce?’

Any questions or comments, please feel free to email and add to the conversation…

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events