We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

The power of position

There’s an awful lot of doom and gloom out there right now. And for pretty good reasons. The graph below caught my eye this week and probably sums up a fair chunk of what’s going on:

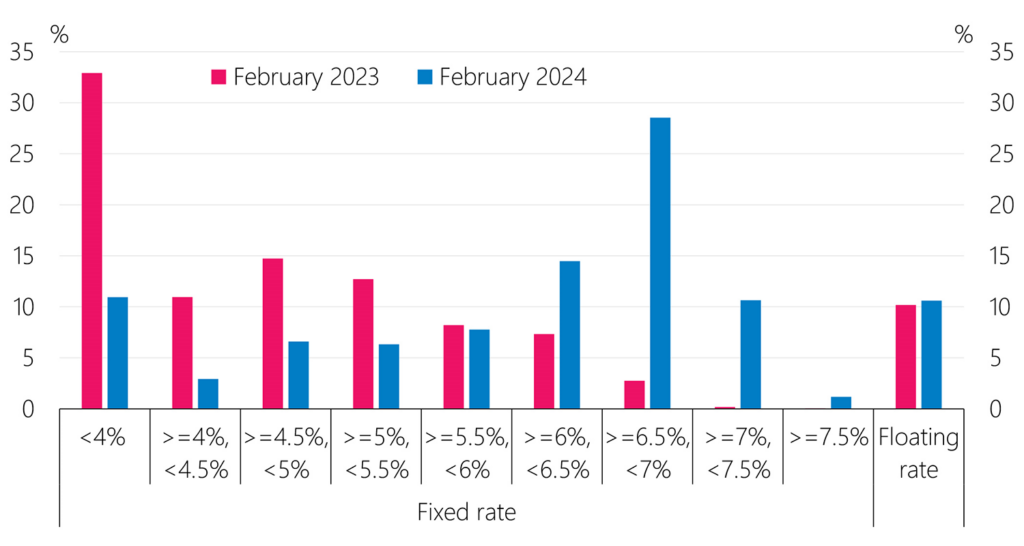

Distribution of mortgage rates across the stock of mortgage lending

This chart shows the distribution of mortgage rates paid by borrowers. As borrowers have reset their mortgage rates, the distribution has shifted to the right. The average mortgage rate being paid is now around 6% (credit to RBNZ).

That is insane. I’m not an economist, so I don’t pretend to know the future. But it seems to me that we’re in for at least six more months of reasonable pain, and then any recovery could take at least another six months. Pushing that bell curve back the other way will take time, and we haven’t even started yet.

If you’re anything like me, you have exposure to a business or maybe a couple of them. I do a wide variety of work for businesses of all shapes and sizes. But I’m also directly involved in a couple of family retail businesses as a shareholder and director. This has been interesting over the last two years, and we’ve needed to make some big decisions, knowing things will likely get worse.

But not just first and second-order consequences fall out of those decisions. So, at the risk of explaining how to suck eggs, the ideas below have been steering a lot of my decision-making in these businesses while the future has been uncertain.

Position is important

Think of “position” as your circumstances, whether you have a lot of debt, are fully invested in commercial property, or are sitting on a mountain of cash. Your position dictates your freedom to make decisions or, conversely, what you’re forced to do when unexpected changes occur. It can be positive or negative. It’s basically your exposure to downside risk or ability to take advantage of future opportunities.

You can consider position when making decisions that would otherwise be benign – like buying a new car, re-fixing your whole mortgage for six months instead of two years, or buying a whole lot of stock while you have high inventory levels. Sometimes, taking position into account when making these decisions means you do things that are a bit weird or counterintuitive: selling stocks in a bull market, not borrowing to buy inventory, restructuring your staff.

There’s no right answer. If you play it too safe, you’ll miss today’s opportunities. If you don’t play it safe enough, it’ll hurt when things change.

And sometimes, your business is just a hungry baby, and you need to feed it.

The rest of the time, when you’re making a decision and there’s a bit of a grey area, think about your position and the decision itself.

Don’t cut off your life to save your limb

In tough times, cash is king, and it doesn’t last forever if you’re burning through it. If your business isn’t performing, you must look into the future and figure out how much longer you can keep going. If you need to have some hard conversations on cutting costs, do it before you run out of money.

It could be renegotiating your lease, repurposing, or restructuring your staff, clearing out your inventory, or selling some assets. Anything like this takes time, so plan ahead and don’t leave it too late.

Get ready for growth

Some incredibly impressive companies were born during the Global Financial Crisis. Airbnb and Uber are pretty good examples, and they changed the world. But they’re also pretty extreme examples—they built unique products on the back of new technology (the iPhone) when traditional businesses were licking their wounds.

If you’re finding things tough, chances are your competitors will be too. Every situation is different, but exploring new ideas in times of challenge can be a real game changer. If you’re well-positioned, you could try and acquire a competitor or a complementary business. Or, if you’re not quite in that position, technology like Generative AI could be a game-changer that gives you an edge. It’s moving at a pace of innovation that’s arguably never been seen before, and it will shake things up more than we can imagine, and it will have a massive effect on most industries.

If (when) the recovery comes, those who are well-positioned and ready for growth will take the lead and change the world.

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events