We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

Payroll – make it better

Every employer has to process payroll for their employees. A reliable and effective payroll system becomes critical as the company grows. For a small-medium business, you have probably tried processing payroll manually, but payroll software can simplify and streamline your in-house payroll process.

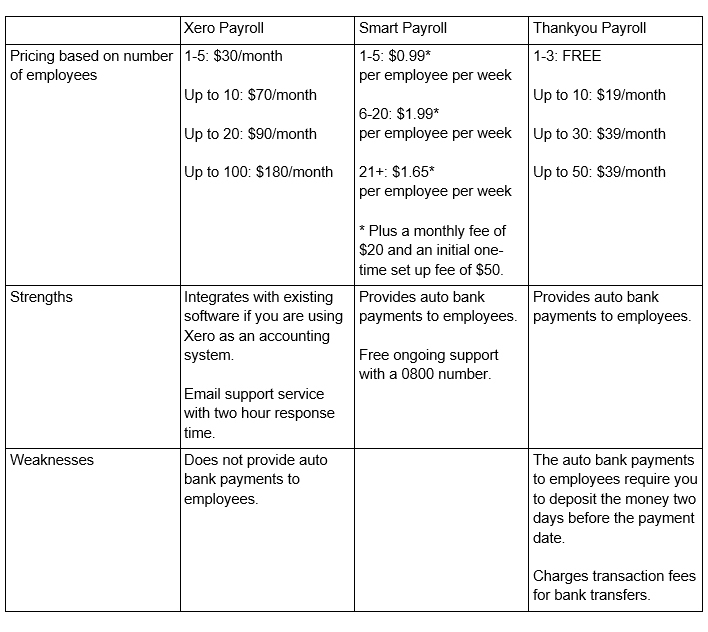

The most common payroll software for small businesses are Xero Payroll, Smart Payroll and Thankyou Payroll. There are more, but too many to list here. Here are some current trends to be aware of when selecting the software that works for you.

- Cloud based

Cloud based means that the software can be accessed from anywhere as long as you have an internet connection. You don’t have to buy updates for the software as you would with traditional on-premise systems, because any changes in employment law or tax law, are updated online automatically.

- Mobile accessible

Many of the cloud-based software also offer mobile apps for smartphones and tablets. Some of these provide opportunities for employees to enter their timesheet through their phone.

The following table shows comparisons among the three most popular payroll software for small business:

IRD’s new payday filing requirements

Following the IRD new payday filing requirements, we are expecting there will be more updates to payroll software. IRD’s payday filing requirements are from 1 April 2019, and employers must:

- File employment information every payday instead of an employer monthly schedule (IR348)

- Provide new and departing employees’ address information, as well as their date of birth (if they have provided it to you)

- File electronically (from payday compatible software or through myIR) if your annual PAYE/ESCT is $50,000 or more.

Note: The due date for payment remains the same at the 20th of the month (or 5th and 20th of the month for twice-monthly filers).

A good payroll software can save you from tedious processes and increase accuracy, so it’s very important that it’s set up correctly. GS provides personnel payroll training and can complete the set up for you, saving you time and cost to fix it later. We also provide ongoing training and answering queries anytime you need. So talk to our Payroll Guru today and relax!

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events