We are recognised as authorities in our specialised fields. We publish newsletters with informed opinions that are free for you to subscribe to.

Dumping and unintended consequences of trade tariffs

Arran continues his series of articles around trade tariffs and how these will impact on New Zealand (NZ) businesses.

In this article, he covers:

- Asia decoupling from the United States (US)

- What that will mean for New Zealand (NZ) importers and consumers

- How Gilligan Sheppard can assist importers with negotiating supply contracts

- The risk of deflation in the Asia Pacific sphere

- Dumping and the impact for NZ on World Trade Organisation (WTO) timeliness

- The unintended consequences of tariffs on iconic brands

- Rules of origin and the stinging tariffs imposed if you get this wrong

The Asian heartbeat

Having just returned from Asia, the only topic discussed at every meeting, dinner, coffee catch up is Trump and tariffs. And I also witnessed first-hand the lines in factories closed, which just a couple of months ago were bustling, fully employed, and producing goods destined for the US market. Now, those lines are silent. And employees have either been dismissed or, at the very least, on long-term unpaid leave.

While China and the US decide where the final tariffs levels will be between themselves, the other Asian countries are negotiating frantically to see where they will also settle. It now seems almost certainly, the tariff levels announced on ‘liberation day’ are not the final picture. But that leads to uncertainty, which burns the confidence to keep manufacturing for that market. In short, producers need long term stability, and the stigma of the US is now the opposite of that.

There is no doubt the US is a large consumer-based economy, which has been attractive to growing economies and companies for decades. But the picture of changes being announced, almost as the wind changes, or what movie was last seen by Trump (i.e., Alcatraz!) has shifted sentiment more than what NZ might yet understand.

In short, Asian companies are actively putting in place plans to ‘decouple’ from the US. And this is being supported by Government policies, subsidies, incentives and the like to help them negotiate this change. Even if the final tariff regimes are drastically less than the ‘liberation day’ rates, they no longer trust the US Government to provide any consistency, which they rely upon for long-term planning (or even short-term manufacturing lines).

The impact on NZ consumers and producers

These Asian companies desperately need cash flow. As they pivot from the US, they have excess inventories, and unused capital investment in production lines which are often highly geared. In short, they are burning through any cash reserves and credit lines open to them (see my previous article around credit terms for exporters to Asia). They are looking at recovering just the marginal cost of stock on hand to stay afloat. Where they might previously have obtained a Gross Profit (GP) margin of 30-60%, they are now looking at 6-8%. This is seriously dangerous for all.

You could have an isolated US market suffering from high inflation due to the domestic impact of tariffs with parts of Asia suffering from deflation where consumers delay purchasing in the belief it will be cheaper later – and you only have to look at Japan to see what economic carnage deflation causes.

For the NZ consumer you should see reduced prices on goods being imported from Asia. That does depend upon how good NZ importers are at negotiating new supply contracts (Gilligan Sheppard can assist any importers with this), and whether they pass on those reduced prices to consumers or hold the extra margin internally. I suspect there might be a bit of both. Some importers will welcome a stronger profit line, but competitive pressure will force at least some of the reductions in prices through to the consumer.

Dumping and WTO

Some Asian companies have such high inventories which were intended for the US market that they must now consider ‘dumping’ those goods on other markets. Dumping is where the goods are sold at less than the cost of production.

China, Cambodia, Vietnam, Malaysia to name just a few, are likely to commence dumping in the near future. The EU has already imposed some ‘anti dumping’ tariffs on China’s electric cars which they believed were being sold in those markets at less than cost to establish brand and market positions.

The WTO is the body charged with settling trade disputes. NZ has been a regular user of the WTO including the stoush with Australia over access for NZ apples.

The US had threatened during Trump version one to withdraw from the WTO. To date, that has not occurred.

I am certain there will be an increase in the claims of dumping and the WTO will be asked to arbitrate. The WTO is the correct avenue for this, but it moves with the speed of a snail ascending Mt Ruapehu. For NZ, that uses the WTO from time to time on market access, you should expect greater delays in having those cases heard and resolved.

In the meantime, the NZ Government must be much more active in ensuring it takes strong and urgent action where dumping occurs. In my view it should work with Australia on these issues – as it is likely dumping will occur in both markets simultaneously.

Unintended consequences of tariffs

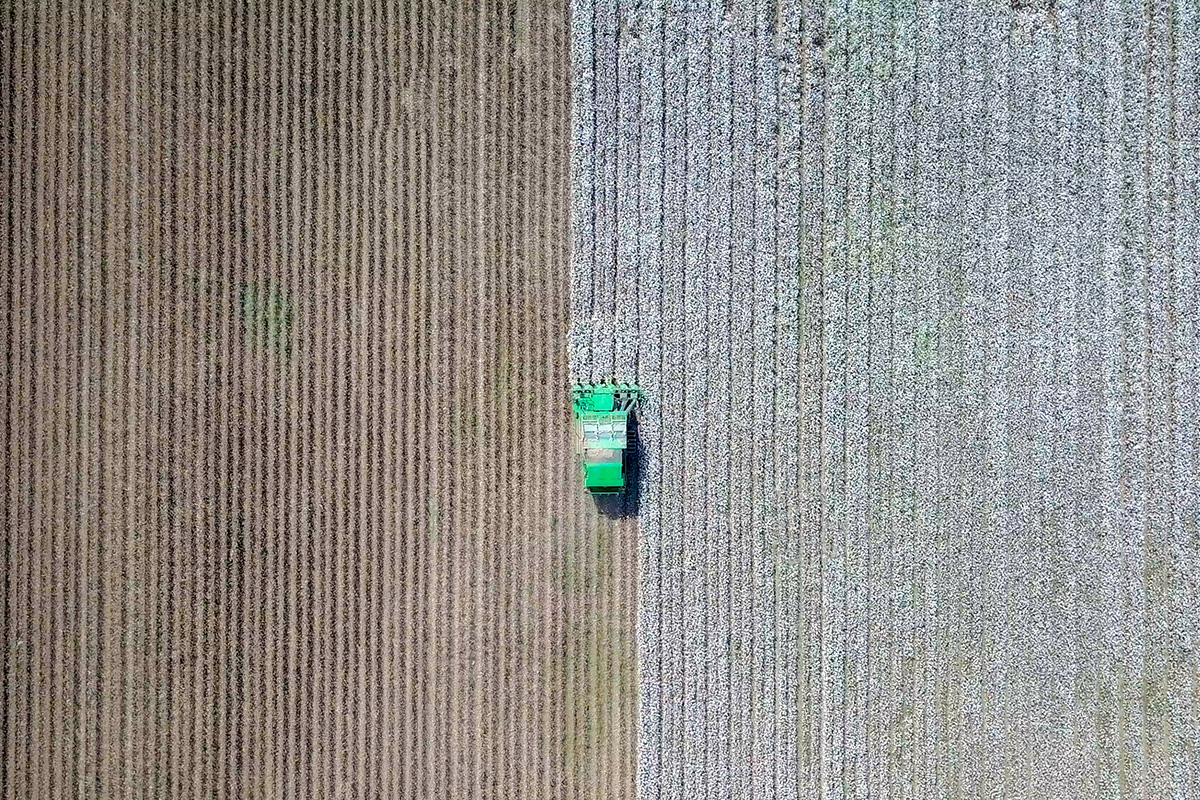

For those of you with at least a passing connection to the agricultural and horticulture industry will know the name John Deere. An iconic US brand with a reputation for highly reliable top end equipment. If you have ever driven across the US plains with the miles and miles of maize, soya, and cotton, you will have seen the large green John Deere tractors, harvesters, and ploughs dotted over the landscape. For decades John Deere has been the US staple for farmers.

Even on my avocado orchard we have a John Deere flat board tip truck, and though it is 35 years old and done countless hours, still works as good (well almost as good) as when it was first imported.

John Deere in the US was under competitive pressure from Kubota and Yanmar. Both brands had improved their engineering and had a price point significantly less than John Deere. You could, of course, assume that the tariffs would assist John Deere in the domestic US market.

But in fact, the tariffs have bought forward the plans of John Deere to move manufacturing to Mexico – the exact opposite of what Trump intended.

The tariff on imported steel of 25% and the vehicle tariffs on parts moving from Canada to the US mean John Deere cannot produce at a cost-competitive rate in the US anymore. Their expanding markets are the new agricultural bases in Columbia, Argentina, and Brazil. To retain even part of their market share, and compete with Kubota and Yanmar, all of the equipment for these markets is moving directly to Mexico. They have already cut the ground and are expected to be in full production by mid-2026. With it goes the capital investment, the high paying engineering and assembly jobs, and the add on services by third parties providing goods and services to John Deere. What is the response from Trump? Any goods imported from Mexico by John Deere into the US will have a specific tariff of 200%. Is that going to be his only card – tariff the living daylights out of any US firm moving across the border?

Rules of Origin and if you get it wrong – 3,521% tariff.

Part of my trip to Asia included a visit to Cambodia where I was able to have a session with both the Minister responsible for trade negotiations and also the chair of the Cambodia-US Chamber of commerce.

Cambodia is at the very tip toe edge of the tariff economic cliff. 40% of the country’s gross domestic product (GDP) is solely based around exports to the US. Yes, you read that correctly – not just 40% of its exports but 40% of the entire GDP is directly related to exports to the US.

They import around US$240m of goods from the US (primarily Jeep vehicles and some agricultural equipment) and export US$3.5b of goods to the US (primarily footwear, leather goods, garments, and toys). So any tariffs would have a major impact and, at 49%, would be nothing short of devastating.

As I pen this article, the trade negotiation team are meeting with the US officials to see what they can reduce the tariff too. They did impose quite stiff import tariffs on US sourced goods – often at 100% and have already offered to reduce these to 5%. The chamber of commerce had urged a 0% but the government stuck to 5%. We will see where these negotiations go but the economic livelihood of Cambodia depends upon those negotiations.

I have mentioned in a previous article the absolute importance of correct rules of origin compliance. The US have imposed on a tariff of 3,521% on Cambodia solar panels, which immediately ceased all production. Why did the US impose such a tariff which resulted in the cessation of solar panels being exported by Cambodian manufacturers? The reason is, at least partly, the rules of origin.

It is alleged that Chinese solar panel manufacturers faced with tariffs for exports to the US, simply transported those panels across the border to Cambodia, repackaged them as ‘made in Cambodia’ and exported them to the US.

The US was onto this quite quickly, and was able to determine that the origin was indeed the People’s Republic of China (PRC) and not Cambodia. As it was a full breach of the Rules of Origin (ROO) they imposed a 3,521% tariff.

Now that is an extreme case of a breach of the ROO. But it also reinforces just how critical compliance (and proof of compliance) for NZ exporters will be. If you need any assistance with ROO compliance, let us know.ch with Arran to discuss how these changes might affect your business and what steps you can take.

If you don’t know where to begin, want to talk through something, or have a specific question but are not sure who to address it to, fill in the form, and we’ll get back to you within two working days.

Find out about our team

Look through our articles

Read more about our history

Business Advisory Services

Tax Specialist Services

Value Added Services

Get in touch with our team

Want to ask a question?

What are your opening hours?

AML & CFT Act in New Zealand

Events with Gilligan Sheppard

Accounting software options

Where are you located?

Events